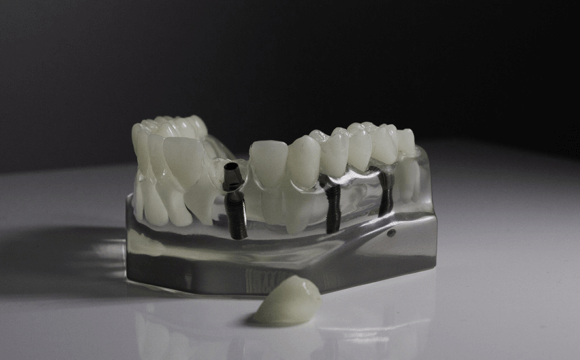

Transform your smile with All-On-6 dental implants from Trust Dental Care in Tijuana, Mexico. This innovative solution is perfect for those looking to restore a full arch of teeth. The procedure begins with an initial surgery, where six precision-placed titanium posts are inserted into the jawbone.

Dental Treatments in Mexico

Welcome to Trust Dental Care, your premier destination for top-notch dental care in Tijuana, Mexico. Our comprehensive treatments are designed with your well-being in mind, ensuring personalized care tailored to your unique needs.

Experience the difference of world-class dentistry in Tijuana Mexico at Trust Dental Care – your trusted partner for a radiant and healthy smile at an affordable price.

All-on-4 Dental Implants

Experience the revolution in dental care with All-on-Four implants from Trust Dental Care in Tijuana, Mexico. These implants offer a secure, natural-feel, and cost-effective solution for tooth replacement. With All-on-Four implants, you can enjoy your favorite activities just like before, without the discomfort or inconvenience of traditional dentures.

Dental Emergencies

In the face of dental emergencies, place your trust in Trust Dental Care. We provide immediate, empathetic care using state-of-the-art technology when it matters the most. Don’t let dental emergencies leave you in distress. With Trust Dental Care, you’re in capable and caring hands.

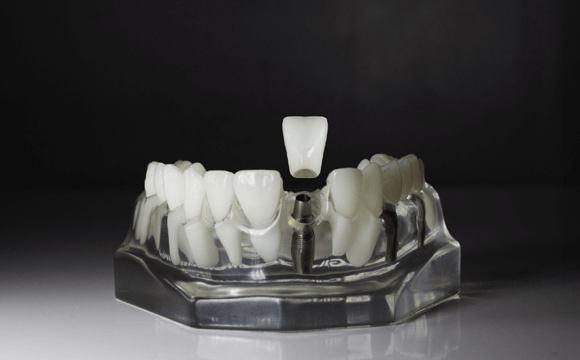

Dental Implants

Revolutionizing tooth replacement, dental implants offer confidence in your smile's stability, strength, and beauty. No more relying solely on dentures!

Dental Crown

Discover the convenience of One-Visit Porcelain Crowns at Trust Dental Care in Tijuana, Mexico. Our swift, effective, and affordable procedure ensures a strong, healthy smile in just one visit. With our expert dental team, you’re guaranteed excellent results. Say goodbye to multiple appointments and prolonged procedures.

Tooth Extraction

Considering a tooth extraction in Tijuana? Trust Dental Care is your ideal destination. Our team of dental experts is committed to making your tooth extraction process as smooth and painless as possible. We understand that dental procedures can be daunting, but with us, you can put your anxieties at ease.

Laser Teeth Cleaning

Experience the future of dental hygiene at Trust Dental Care, a leading dental clinic in Tijuana, Mexico. We specialize in laser teeth cleaning, a state-of-the-art procedure that offers a comfortable, efficient, and affordable alternative to traditional methods.

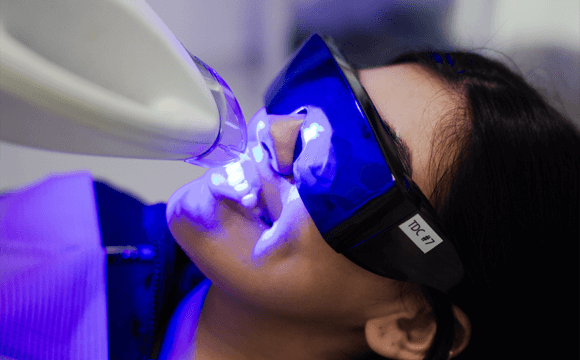

Teeth Whitening

Are yellow teeth dimming your confident smile? Worry no more! Trust Dental Care in Tijuana, Mexico, offers top-notch teeth whitening solutions. Our treatments are designed to remove stains and lighten the color of your teeth, giving you a brighter, more confident smile. Don’t let yellow teeth hold you back.

Meet Our Dental Offices In Tijuana

Welcome to Trust Dental Care, your premier Tijuana dental clinic in the heart of Mexico. Nestled in the vibrant city of Tijuana, our clinic stands as a beacon of excellence in dental care. Discover a state-of-the-art facility equipped with cutting-edge technology, providing world-class dental solutions right here in Tj Mexico. Our team of skilled dentists is dedicated to offering personalized care that ensures your comfort and confidence. Explore our clinic through photos capturing the inviting atmosphere and meet our experienced dentists whose profiles reflect their expertise and commitment to your oral well-being. Join the countless satisfied patients who have experienced the exceptional dental care that Trust Dental Care is proud to offer in Tijuana Mexico.

Why Trust Dental Care is Your Best Choice

At Trust Dental Care, we put your oral health and well-being first. Our team of experienced professionals is known for their expertise and dedication, providing top-tier, personalized care in our state-of-the-art facility.

We distinguish ourselves for our commitment to advanced technology and our consideration of Tijuana dentist costs and accessibility in Mexico. We ensure your comfort and deliver exceptional results.

Our focus on affordability, transparency, and a welcoming atmosphere makes Trust Dental Care your trusted partner for a healthy, confident smile. Experience the Trust Dental Care difference in Tijuana, Mexico – where your smile is our priority.

We have a team of specialists in the office to make you feel welcome. We strive to maintain great communication with our patients from start to finish, embodying the commitment to excellence that defines Dentists in Mexico at Trust Dental Care. Additionally, our staff is ready to assist you in Spanish and speak English for seamless communication throughout your visit.

We use Sirona 3D CT Scans, CEREC one-visit crowns, and Computed Guided Implant Surgery technology for better results. All of our technology is state-of-the-art.

Cost Comparison: United States Dental Work vs Tijuana Dentists Price

All on 4

$9,500

USA : 35,00.00

Evaluation

$60

USA :200.00

Titanium Dental Implants

$799

USA : 6,7.00

Dental Painless Extraction

$120

USA : 300.00

Testimonials

Our Team: Specialists Committed to Your Comfort

At Trust Dental Care, we have a team of specialists who are dedicated to making you feel welcome. We attempt to maintain excellent communication with our patients from start to finish, personifying the commitment to excellence that defines our dentists in Mexico.

In addition, our staff is proficient in both Spanish and English, ensuring seamless communication throughout your visit. Experience the difference at Trust Dental Care in Tijuana, Mexico – where your comfort and safety are our priority.

Dr. Serena Kurt, DDS, a renowned Cosmetic Restorative Specialist at Trust Dental Care in Tijuana, Mexico. As a US-licensed dentist in California and a fully accredited member of the American Academy of Cosmetic Dentistry (AACD), Dr. Kurt is one of only 228 dentists worldwide to achieve this distinction in the past 35 years.

Doctors worldwide trust Dr. Kurt for her world-class dentistry services offered at affordable pricing. In just the last year, she has created over 100 full-mouth extreme makeover cases, crafted 1000 veneers, and placed 1200 crowns. These numbers are lifetime accomplishments for many dentists, but for Dr. Kurt, they are a testament to her dedication and skill.

With over 16 years of professional experience, Dr. Kurt has created more than 20,000 crowns and veneers. Her commitment to excellence is further demonstrated by her recent achievement: she not only passed the Western Regional Boards Exam (WRBE), considered the hardest dental exam in the world, but also achieved the highest score ever recorded.

Dr. Alejandra

Cosmetic Dentist and Implant Specialist

Dedicated to creating smiles and promoting oral health. Driven by a passion for dentistry, Alejandra, a graduate of the Autonomous University of Baja California, strives to deliver exceptional patient care. With unwavering respect and commitment to her craft, she ensures each visit is comfortable and tailored to individual needs.

Dr. Denisse

Cosmetic Dentist and Implant Specialist

Denisse, a distinguished Autonomous University of Baja California graduate, is a skilled dental implant specialist known for her unwavering patience and meticulous approach. With a warm and friendly demeanor, she creates a comforting environment for her patients. Denisse's exceptional creativity shines through her work, ensuring each smile is transformed into a masterpiece.

Dr. Erika

Cosmetic Dentist and Implant Specialist

Erika, a distinguished graduate of Autonomous University of Baja California in Oral Rehabilitation, is equipped with a wealth of knowledge and experience in dentistry. Highly dedicated and committed, she not only holds academic excellence but also boasts practical expertise in the field.

Dr. Raquel

Dental Assistant

Raquel, a Dental Assistant, embodies diligence and responsibility in her role while maintaining a genuine passion for dentistry. Her commitment to providing excellent dental support is evident in her dedicated and detail-oriented approach.

Dr. Gustavo

Surgical and Implant Specialist

Known for his calm demeanor and ability to handle complex surgical scenarios with confidence, Gustavo is a respected figure in the surgical realm. His commitment to patient well-being and his continuous pursuit of excellence make him an invaluable asset to the field of surgery in Tijuana.

Dr. Frida

Dental Assistant

Frida, a Dental Assistant and recent graduate of Autonomous University of Baja California with a degree in dentistry, brings with her a wealth of determination, eloquence, and keen observational skills. Despite her recent entry into the professional arena, Frida has exhibited exceptional qualities that set her apart in the field of dentistry.

Tech. Raul

Ceramist Artist

His expertise lies in the creation of dental prosthetics, where his commitment to excellence is evident in every piece he meticulously crafts. Raul's work not only reflects his proficiency in the technical aspects of his craft but also showcases an artistic sensibility that transforms smiles into true works of art.